In this series, which we hope to bring to you on a regular basis, we’ll be detailing some of the key numbers and trends that we’re seeing in terms of dealer connections made through our site.

As this data is considered somewhat representative of broader industry activity, and serves as one of the more insightful leading indicators for potential car sales, we hope it will fulfil a few purposes for our broad audience. First, to document not just how we’re performing as business, but how dealers and the wider market stand to perform, so you don’t have to wait til that next set of official sales data.

Without further ado, here’s what happened over the last week.

Total new car enquiries

In the week ending Sunday, September 20, we recorded 948 dealer enquiries relating to new cars. That represented a week-on-week increase of 1.9%, or 18 additional connections, while also seeing car buying interest hold somewhat steady within a narrow range across the last month or so.

Last week’s unemployment data proved particularly positive, coming in significantly better-than-expected and showing a large number of jobs returning to the economy outside of Victoria. This trend bodes well for consumer spending and interest in new cars, at least as a leading indicator, however, the depth of the recession could still well be felt for many months or years yet.

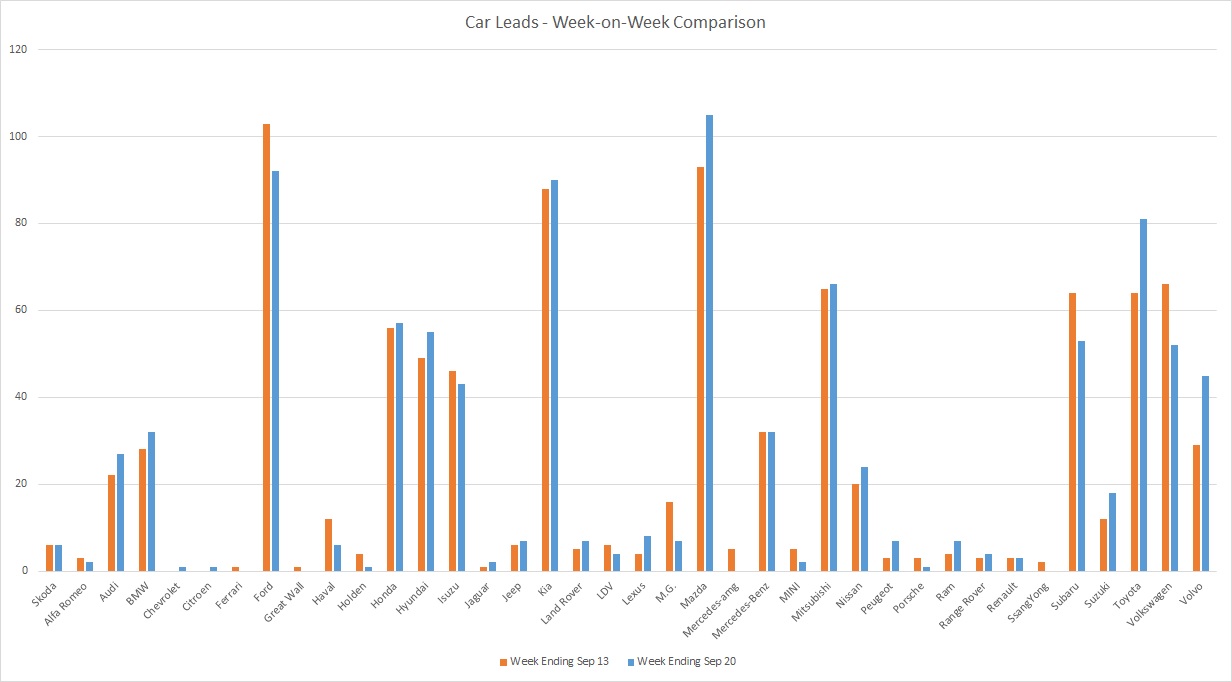

New car interest by brand

Mazda returned to the top of the charts last week, with the brand seeing the most enquiries of any other across the market. There was a 12.9% increase in dealer connections for the brand relative the week prior.

Kia, Mitsubishi and Honda saw buying interest roughly in line with the seven-day period a week earlier, which contrasted the fortunes of Ford and Volkswagen, where dealer connections eased from what were more or less record highs.

Toyota enjoyed a stellar week courtesy of an extra 17 dealer leads, however, the surprise result came from Volvo, where we observed some of the highest levels of interest in the brand since PriceMyCar was launched.

|

Prospective New Car Buyer Numbers |

Sep 14 – Sep 20 |

Sep 7 – Sep 13 |

% Change in Enquiries |

|

105 |

93 |

12.9% |

|

|

92 |

103 |

-10.7% |

|

|

90 |

88 |

2.3% |

|

|

81 |

64 |

26.6% |

|

|

66 |

65 |

1.5% |

|

|

57 |

56 |

1.8% |

To get FREE access to instant pricing on just about every new car make and model, plus guaranteed discounts, sign up today